Series 2 of 2: Growth vs. Value Analysis – Is AAPL a Buy, Sell or Hold?

The Case for Value – AAPL Valuation Analysis (Continuing from Series 1)

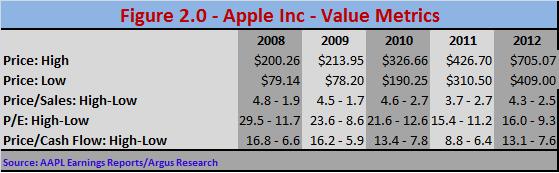

Historically, especially over the last 3 years, AAPL stock has traded at a relative P/S ratio of between 2.5 and 4.6. However, its P/E ratios have dramatically declined from a 2010 range of 12.6 – 21.6 to a 2012 range of 9.3 – 16.0. This decline is a clear indication that, on a P/E valuation basis, the stock is definitely cheaper than it was back in 2008, when it traded within a P/E range of 11.7 – 29.5.

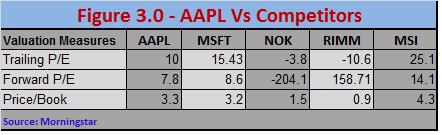

Looking at the competitive landscape makes for some interesting value-based comparisons between AAPL and some of its competitors.

When compared to its rivals, both on a Trailing and Forward P/E valuation basis, AAPL appears to offer a better value proposition to its shareholders than some of the other companies. Analysis of both metrics seems to confirm that the Apple share price is a bargain.

Shareholders looking for AAPL to deliver more value to them will also be encouraged by the fact that, thanks to its huge cash pile, the company could deliver some of that cash back to them by adding value through "share buy backs", and even possibly a dividend program. The new Corporate Controller, Luca Maestri, formerly the finance chief at Xerox (XRX), is known as a "shareholder friendly" executive, where he has a track record of similar value addition to XRX shareholders.

Margin of Error

For AAPL, like any other company in the PC/Smartphone business, growth will be a function of margins. The higher the margins, the greater growth it will deliver to investors. In its latest earnings report the company confirmed that sales of cheaper and older iPhone models were a contributing factor in the firm's lower financial margins.

There is talk that Apple plans to release a newer, lower-cost iPhone model for the Chinese/Asian market later this year, primarily to thwart the momentum from locally manufactured cheaper devices by Chinese competitors. The move to focus more on the low-cost iPad Mini too seems to have taken a bite out of revenues from the higher end iPad. Clearly, as customers flock to cheaper Apple devices, and as competitors introduce cheaper devices of their own, there will undeniably be margin pressures that will stymie growth.

The Bottom Line

Based on the analysis above, AAPL looks like a great value stock for now, with a definite potential for regaining its place as a growth story in the future.

Shareholders may well wonder: Will Apple ever rise again? The answer is “It depends”. For one, it depends on how Microsoft's Windows Phone fares in the coming few quarters. It also depends on how well Research In Motion's BB-10 launch goes in the next few weeks. It also depends on what new products AAPL decides to unveil over the next few quarters. The announcement of a 128GB next gen iPad this week is definitely a good start. However, AAPL needs to display that, post Steve Jobs, it has a strong visionary at the top that can still inspire investors and consumers with the same Jobs-era spirit of innovation.

Is AAPL a good buy at these levels? The answer is “Yes”. At least 15 analysts covering the stock have an average price target of around $656.79, a drastic reduction from its pre-Q1 2013 earnings announcement level of $716.94, but still higher than it sits today (Jan 29) at $460.

(By: Monty R. – MarketConsensus News Contributor)

Good luck in your investing. Let us know if you have any questions, comments or feedback,

MarketConsensus Stock Analysis Team

Stay In Touch:

Facebook (Like Us on Facebook)

Twitter (Follow Us on Twitter)

Google + (Connect with Us on Google+)

Contact Us (Questions/Comments)

Enter your e-mail address on the “Never miss a post!” section on the top right of this page and receive articles as soon as they are posted.

————————————————————————————————-

[related2][/related2]