Charles Schwab Stock Performance – Is SCHW Stock a Good Buy or Sell?

Is SCHW stock a good buy and hold, or a sell? While Charles Schwab’s (SCHW) stock price has largely moved in lockstep with its peers E*Trade, T. Rowe Price, and TD Ameritrade, SCHW has started to visibly outperform all three competitors as seen in the below chart. Year to date, Charles Schwab stock has risen by over 38%. Given this situation, investors may be wondering if they should still buy and hold Charles Schwab stock at the existing price or sell and look for value elsewhere. Let's try and answer these question through our below fundamental, valuation and technical stock analysis.

Stock Chart

Charles Schwab (SCHW), E*Trade (ETFC), T. Rowe Price (TROW), and TD Ameritrade (AMTD)

Charles Schwab (SCHW) Analysis – Does Charles Schwab Make a Good Investment?

- Fundamental Analysis

- Charles Schwab Comparative Valuation Overview

- Technical Stock Analysis

- Favorable Catalysts for the Stock

- Bottom Line Conclusion

- Fundamental Analysis (Buy, Sell or Hold Charles Schwab Stock?)

While still a strong contender in the online trading business, Charles Schwab Corp (SCHW) has diversified into other higher-margin lines of business, such as personal finance, asset management and integrated banking and lending solutions, including low-cost loans, checking accounts and other traditional and mobile banking services.

In April, the company reported Q1 financial results. Net Revenues were up by 8% on a year-over-year (Y/Y) basis, coming in at $1.3B. This marked a sequential increase of around 6.17% from the Net Revenue of $1.22B reported in Q1 of the previous year.

The company's Net Income came in at $206M, which was a 6% rise compared to the same quarter of last year, but 2% lower on a sequential basis. SCHW's Earnings per Share (EPS) for the quarter remained flat at $0.15, both on a sequential as well as a Y/Y basis.

See Also: 15 Best Business Blogs and Top Financial News Sites (for Stock Investors)

Although revenues have been improving, a troubling aspect of the financial results lies in the company's inability to keep on growing its margins. Pre-tax profit margin for the first quarter was reported at 25.7%, which was 0.60% lower on a Y/Y basis, and 2.6% lower on a sequential basis. The company's Return on Equity was down by one percentage point on a Y/Y basis, but remained sequentially flat at 9%. These numbers highlight the challenging impact that increasing competition is having on the company's bottom line and profitability.

There was good news buried in the results as well. Net new assets totaled $43.4B, which was the highest Q1 number for the company since 2000. Charles Schwab also managed to add 244,000 net new brokerage accounts to its list, which amounted to a 2% Y/Y increase. The firm's Retail Advisory service saw a $4.7B inflow in new enrollments, which represented a 70% increase Y/Y. Mortgage and home equity loans totaled $10.3B for the quarter, up 5% sequentially and 14% Y/Y.

See Also: Barclays Online Banking – Complaints, Reviews and Issues?

While the company’s EPS missed stock analysts’ consensus by a penny, its quarterly revenues were in line with Wall Street’s Q1 market consensus. For the next 2 quarters stock analysts are estimating that the company will generate EPS of $0.19 and $0.20, with consensus revenue estimates remaining flat at $1.3B for both Q2 and Q3. Management has offered pre-tax profit margin guidance of “at least 30%", and expects EPS to be in the mid $0.70 range for the entire 2013 (the market consensus for 2013 EPS is $0.74).

- Charles Schwab Comparative Valuation Overview (Buy | Sell Charles Schwab Stock?)

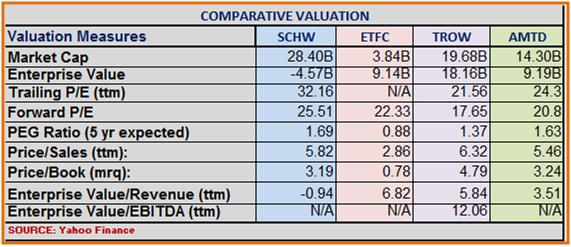

On a Trailing P/E valuation, SCHW is trading at a multiple of 32.16x its trailing 12-month earnings. That means it is currently trading at a significant premium to its competitors: T. Rowe Price (Stock: TROW | Market Cap: 21.56x), and TD Ameritrade (Stock: AMTD | Market Cap: 24.3x).

Other News: Why is BAC Stock a good Buy? Bank of America Valuation Analysis

At 25.51x, SCHW's Foreword P/E valuation could be considered much more in line with its peers E*Trade (22.33x) and AMTD (20.8x), but significantly higher than the 17.65x valuation of TROW. This makes it the most expensive stock of the 4 peers being reviewed here.

On a TTM Price/Sales valuation, SCHW is trading at a multiple of 5.82x its trailing 12-month sales. This puts it in line with the valuation of AMTD (5.46x), and at a slight discount to TROW (6.32). However, all three peers appear to be trading at a significant premium to ETFC's (2.86x) P/S valuation.

ETFC offers the most attractive (cheapest) valuation on a Price/Book metric (0.78x). While SCHW (3.19x) and AMTD (3.24x) are trading at approximately similar P/B valuations, TROW (4.79) is trading at a significant premium (most expensive) to its 3 other peers.

Other News: Top 10 Best Forex Brokers, Futures and Options Trading Firms (2013 Review)

Investors should always be on the lookout for good companies with good growth rates, especially on a longer-term (5-year) horizon, that are trading at compelling valuations. SCHW's 5-year expected PEG Ratio of 1.69x is the highest of the 4 peers listed here. That means investors will be paying relatively high prices for comparatively lower earnings growth prospects.

Continue: Charles Schwab Stock (Buy, Sell or Hold?) – Technical Analysis, Favorable and Negative Catalysts

[related1][/related1]