It's hard to turn on any television without catching a cheap commercial about the huge rewards gained from investing in gold. Gold prices have had a fantastic run in the last five years, beating the market year after year. Ready to cash in your gold shares? Call one of those flashy 800 numbers and make the switch?

Think again. At this current time, gold is a poor investment: prices are inflated due to the improving economy, the Simon-Ehrlich wager is in effect and gold has reached its climax.

Gold investing normally spikes during times of economic anxiety. Why is this? As people lose faith in a country's economic health, they are more attracted to the value of something physical that will hold its investment even if a country's currency gets wrecked.

[related1][/related1]

In the 1980's the price of gold peaked at $800 an ounce, then it dwindled down as our economy picked up. During the recession stemming from 2008, gold prices picked up steam again and then exploded out of the gate.

Below chart shows the five year rise of gold prices.

Source: Yahoo Finance

Fortunately for our economy, we are making gains and gold prices are beginning to waver. As our fragile economy continues to get better, gold will continue to drop from its euphoric high.

If you've ever taken an environmental economics class then you've probably heard of the Simon-Ehrlich wager. Julian Simon and Paul Ehrlich were economists who believed the world was heading in two very different directions. In 1968 Ehrlich published “The Population Bomb” which made the argument that man was on a collision course with disaster because our population was rapidly outgrowing our supplies (food, water, energy, etc). Simon was confident this was far from the truth.

[related1][/related1]

To contest his book, Simon proposed a wager: He asked Ehrlich to pick any five commodities, and that in ten years, adjusted for inflation, all five would be down. Ten years later, and Simon was correct. Out of the five commodities, every single one of them was selling for less. Why? Mostly because the applications that used these commodities had increased their efficiency of them which lowered their cost significantly. How does this apply to gold?

Gold is used in many electronics, from computers to calculators, cell phones and even televisions. As these technologies continue to improve, they will become more and more efficient with the amount of gold being used, lowering the demand, and causing the value to drop.

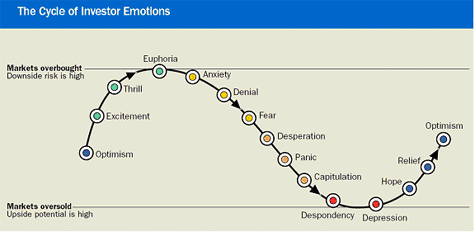

Emotional investing shows a roller coaster path of the business cycle. At its peak, people believed there was no way gold could ever go down in value, that everything was perfect. Look around. Watch the endless television commercials, take note of every gold investment company cropping up, pay attention to how people talk about it. Demand for gold is at this point at a euphoric level (or has just past it). The next stage is the Anxiety stage and then downward.

Source: North Western Mutual. Caption: The different stages of emotional investing.

Finally, there is one additional point I would like to make: Gold isn't much of a utility. Besides its use in electronics it has no real use. Decorations and jewelry don't enter this category. It adds no real value, no matter how long you hold onto it. Warren Buffet puts it eloquently:

“If you buy an ounce of gold today and you hold it at hundred years, you can go to it every day and you could coo to it and fondle it and a hundred years from now, you’ll have one ounce of gold and it won’t have done anything for you in between. You buy 100 acres of farm land and it will produce for you every year. You can buy more farmland, and all kinds of things, and you still have 100 acres of farmland at the end of 100 years”

Investing in gold is a poor decision at this time. It has reached its peak and will continue to decline as our economy improves.

[related2][/related2]