Series 1 of 2: Is NOK a Buy or Sell in 2013? – Can the Firm Take 3rd Place?

Can Nokia Take Third Place in the Smart Phone Universe?

Once considered the #1 mobile phone powerhouse, Nokia Corp (NYSE: NOK) continued making great handsets throughout the early 2000's, while its rivals Apple (NASDAQ: AAPL) and Google (NASDAQ: GOOG) quietly went about kicking off the smart phone revolution.

It took the "burning platform" speech by Stephen Elop (Nokia’s CEO) in February of 2011 for the company to ditch their Symbian and MeeGo operating systems to focus on Microsoft's Windows Phone platform – in a bid to salvage the company’s prospects.

But being that Android and iOS are so heavily entrenched in the smart phone universe, investors may now be wondering whether Nokia can earn a place as the third wheel.

Let’s take a look.

The Fundamentals

When NOK announced its Q4-2012 financial results on January 2013, it reported the 7th straight decline in quarterly revenue. Newsworthy as that announcement was, what was even more startling (though not entirely unexpected by analysts) was the fact that the company was foregoing dividends to shareholders. And why is that newsworthy? Well, throughout its 143 year history, even through World Wars and a separation from the Soviet Bloc, the company has never once omitted dividend payouts – until now!

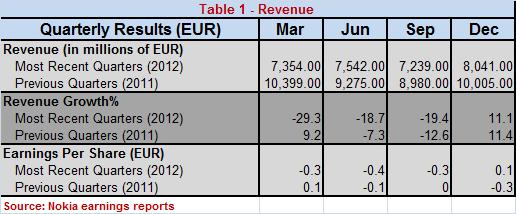

Comparing the 4 quarterly revenue reports of 2012 against prior quarters makes for an interesting assessment of the company's revenue growth. Looking at Table 1 above, we can see that in 2012, Nokia’s revenue grew from March to June and from Sept to Dec. However, we can also see that revenue in 2012 was less than revenue in 2011 (for every quarter), with a year over year negative earnings growth for the 1st, 2nd and 3rd quarter – see the Revenue Growth % section on the above table

For the year 2011, Nokia reported a $1.93 billion annual net income loss (net income = revenue minus expenses & taxes). In order to address their weakening fundamentals, the firm’s management announced an aggressive cost cutting program that would see the slashing of over 20,000 jobs as a means of conserving fast depleting cash reserves and to boost their profit margins. In 2012, the firm’s restructuring and cost cutting efforts have allowed it to recover from its 2011 loss.

But this swing to profitability did not come easily for the company or for its shareholders. Operating from a fundamentally weaker (than its competitors) position meant that NOK had to make some tough compromises on product prices and margins, which ultimately took their toll on overall profitability.

Margin Erosion

In the fourth quarter of 2012, sales of Lumia (Nokia's flagship phone) were up to 4.4 million units. However, total number of phones sold across all product lines were down to approximately 86.3 million units overall. More troubling was the fact that the company reported weak numbers from promising markets like China, where they only managed to sell around 4.6 millon units, a decline of over 69%.

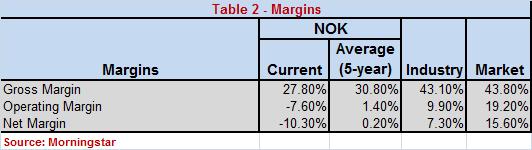

All of this does not bode well for the former handset giant's margins, where more and more local challengers are forcing even leading players like Apple to cut prices and come out with cheaper iPhone models for individual domestic markets. As laid out in Table 2, the company's Gross, Operating and Net Margins have lagged significantly from where they were on a 5 year average basis.

The significant margin gaps between NOK and industry averages may yet be another indication that, in its shift towards a partnership with Microsoft and the Windows Phone OS, the company may have done too little too late.

But is there any hope that a turnaround could be possible in 2013? And should investors hold, buy or sell the stock?

(By: Monty R. – MarketConsensus News Contributor)

See Series 2 of 2: Is NOK a Buy, Sell or Hold in 2013?