Tuesday, April 23, 2013 – Today’s Biggest Losers, Highest Gainers, Advancers and Decliners

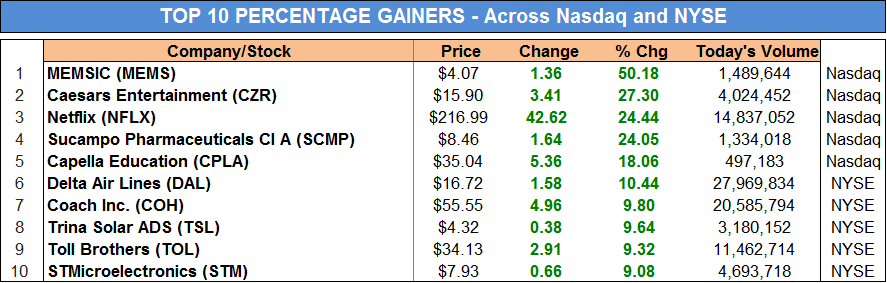

Most Active Stocks – Top Gainers by Percentage Points (NYSE & NASDAQ)

- Shares of Memsic (MEMS) soared 50.18% to end the day at $4.07, based on news that the firm will be acquired by IDG-Accel China Capital II and Affiliates at a deal worth $4.225 per share. “The Board of Directors of MEMSIC, in approving the transaction, acted at the unanimous recommendation of a Special Committee, consisting of the company’s three independent directors, that was appointed in November 2012 to consider the IDG proposal and the company’s other strategic alternatives.”

- Caesars Entertainment Corp saw its shares surge 27.30%. As reported by the AP, “Caesars Entertainment plans to create new a growth-focused company with private investors.”

- Netflix shares were the third highest gainers across the Nasdaq and NYSE, rising 24.44% to close at $216.99 based on better than expected earnings.

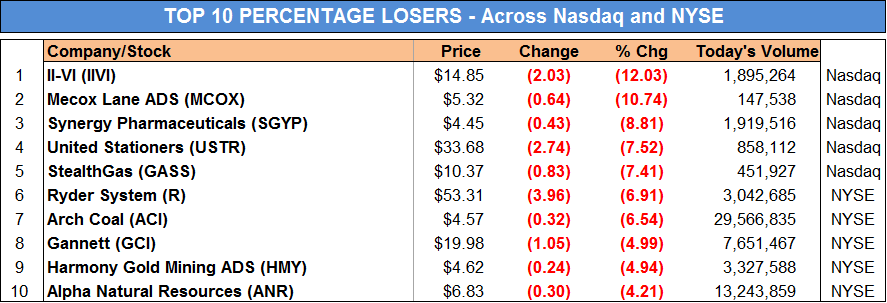

Most Active Stocks – Top Losers by Percentage Points (NYSE & NASDAQ)

- II-VI, Inc. was the biggest stock loser today, dropping 12.03% to end the day at $14.85. Investors rushed to sell the company’s stock after it reported a $145.2 million revenue figure that missed Wall Street expectations.

- Shares of Mecox Lane Ltd were the next highest stock losers dropping 10.74%, after the firm reported Q4 and Full Year 2012 numbers that disappointed investors.

- Synergy Pharmaceuticals fell 8.81% making it the third biggest stock loser across the Nasdaq and NYSE.

Good luck in your investing. Let us know if you have any questions, comments or feedback,

MarketConsensus Stock Analysis Team

Stay in Touch:

Facebook (Like Us on Facebook)

Google + (Connect with Us on Google+)

Twitter (Follow Us on Twitter)

Contact Us (Questions/Comments)

————————————————————————————————-

[related2][/related2]