Arch Coal Stock Valuation Analysis – Is ACI a Good Buy, Hold or Sell in 2013?

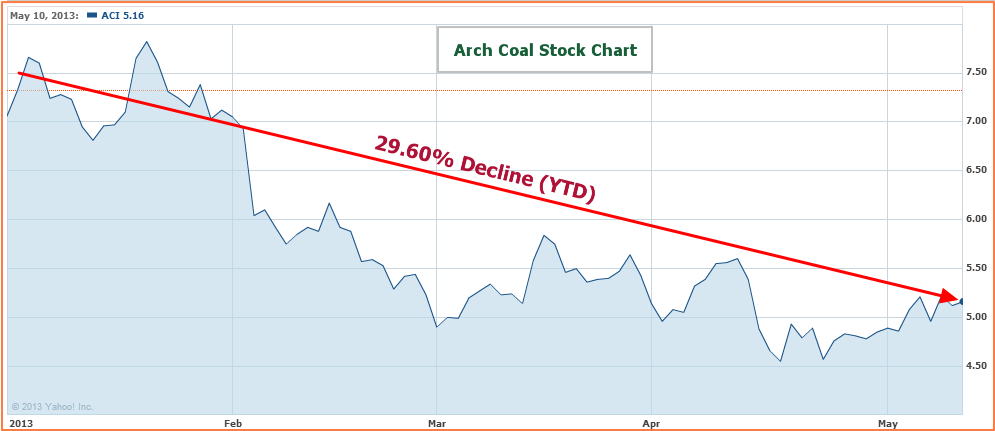

Since the beginning of the year, Arch Coal (ACI)’s stock price has dropped by 29.60%, causing lots of investors to wonder if ACI stock has become a good buy, sell, hold or even a short sale. The decline in the company’s stock price has mostly been due to a plunge in coal demand. Arch Coal produces metallurgical coal, which is used in steel production. Due to decreasing prices of coal alternatives (such as Natural Gas), there has been a shift away from using coal in steel production in favor of the lower cost alternatives.

Given the negative forces impacting the coal mining industry in general, the space has become an extremely difficult place to do business. As is apparent from the 1-year stock chart below, which depicts the stock price movement for ACI and its competitors Alpha Natural Resources (ANR), CONSOL Energy(CNX) and Peabody Energy (BTU). Besides CONSOL Energy, all the major coal players have experienced steep decreases in their stock price, starting the beginning of this year.

Given this reality, stock investors may be wondering whether it makes sense to buy and hold Arch Coal stock (ACI) or whether they should look elsewhere for better returns. Let’s assess the company’s fundamental and valuation variables to better determine whether Arch Coal stock is a Good Buy, Hold or Sell?

Arch Coal Inc (ACI) Stock Valuation Analysis Report

- Arch Coal (ACI) Fundamental Stock Analysis

- Valuation Overview for ACI Stock

- Arch Coal Technical Stock Analysis

- Favorable / Negative Catalysts Impacting Arch Coal Stock

- Bottom Line Conclusion

- Arch Coal (ACI) Fundamental Stock Analysis

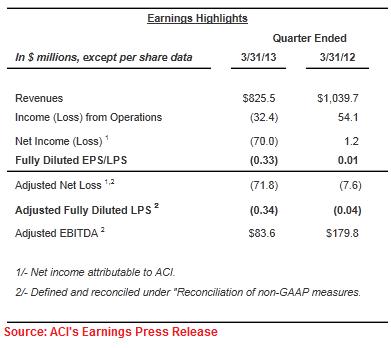

For its Q1 2013 results, ACI reported a less than stellar financial and operational picture. Revenue declined by 20.6% year-over-year due to lower coal prices. In addition, Arch Coal announced operational losses despite cost-cutting and other improvement measures implemented by company management.

Arch Coal, Inc. Reports First Quarter 2013 Results

During the first quarter of 2013, Arch Coal sold 34.1M tons of its products, a drop of nearly 4% from the 35.5M tons sold in Q1 2012. On the bright side however, thanks largely to a well implemented cost-cutting and operational efficiency improvement drive, the company reported that it had succeeded in bringing its “Operating Cost per Ton” down by almost 11%, from $24.07/ton in Q1 2012 to $21.46 in the most recent quarter.

However, a major point of concern to investors was the 88% drop in the firm’s Operating Margin, largely due to lower average price per ton sold.

(See Also: 5 Best Online Trading Sites (2013) for Investors – Best Online Brokers)

ACI reported a greater than expected Net Loss of -$70M, leading to a Loss per Share of -$0.34 (versus the -$0.04 Loss per Share reported last year). Despite the poor numbers reported, the firm’s management announced a more optimistic guidance for the rest of 2013, expecting their cost-cutting measures to deliver even more operational efficiencies. They also see U.S. and global coal consumption rising by 50M and 300M tons respectively over the previous year’s demand.

A look at the company's balance sheet reveals that it carries a staggering amount of debt, which was largely caused by its 2011 acquisition of International Coal Group (ICG).

- Valuation Overview for ACI Stock

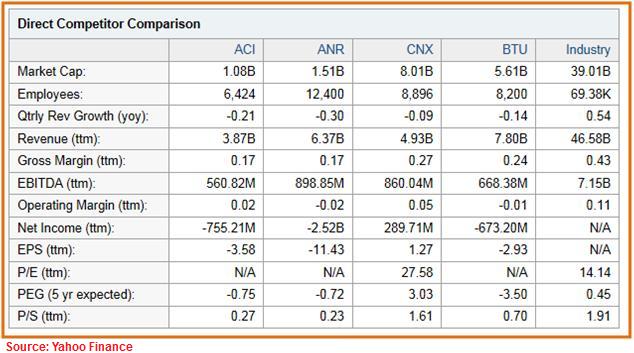

Despite being the smallest (by market cap) amongst its peer group, ACI has performed fairly well, based on Trailing 12-month (TTM) Revenues. For instance, the biggest of its rivals is CNX, which has a market cap that is 86.5% larger than ACI. However, on a TTM Revenue basis, ACI's revenues are only 21.5% lower than CNX's. Being in a cyclical industry that has been particularly hit by declining commodity prices, all 4 of the rivals have had declining year-over-year (Y/Y) quarterly revenue growth.

ACI has a very high Debt/Equity ratio (1.9x), making it the most leveraged company amongst its peers. ANR has the lowest D/E ratio (0.7x) amongst the four.

- Arch Coal Technical Stock Analysis

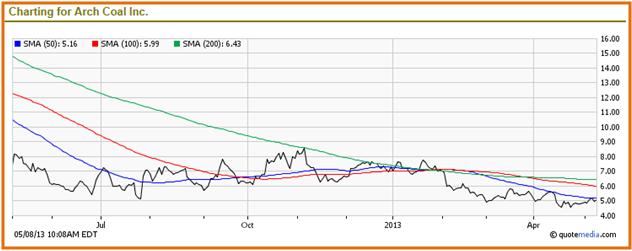

From a technical standpoint, the one-year stock chart above paints a rather dismal picture of ACI's performance, trading below its 50-day and 100-day and 200-day Simple Moving Average (SMA) for the better part of the year.

Since early Feb 2013, the stock has been trending lower, and has been unable to break resistance at its 50-day SMA ($5.16).

(Other News: Why BAC is a good Buy in 2013 – Bank of America Stock Analysis)

Investors would do well to closely watch the company's Q2 results. If management's predictions about impending favorable market conditions pan out, that may be the catalyst that propels this stock higher.

- Favorable / Negative Catalysts Impacting Arch Coal Stock

As the largest operator in the Western Bituminous (WBIT) coal producing region, ACI's fortunes are closely tied to the demand and sale of WBIT (insular) coal. With limited opportunities for ACI to transport and export its WBIT production in an economic way via British Colombia (Canada) and the Gulf of Mexico, the short to mid-term prospects for leveraging these reserves looks bleak. However, ACI's 2011 deal with Ridely Terminals Inc (RTI) to leverage export through the Millennium Bulk Terminal in Washington could prove a longer-term catalyst for growth and increased revenue streams. Environmental opposition could however derail or significantly delay the project.

ACI's Leer Mine project, scheduled to come online in mid-2013, is likely to boost the company's metallurgical coal production by over 3.5M tons. If the project does go live as scheduled, it could command premium prices for steel making coal (over thermal coal) which will certainly be a catalyst for higher revenue.

The downside to tilting its focus to Met coal as opposed to thermal is that it hinges the company's fate to industrial recovery in economies such as China, India and other emerging markets. Any slowdown or stalling in activities such as housing or infrastructure development in these markets will impact steel production, leading to a negative catalyst for ACI's earnings.

(Other News: AMD Stock is Down 58%. Will It Rise in 2013? And is it a Buy or Sell?)

ACI's 2011 acquisition of International Coal Group (ICG), has not proven accretive for shareholders thus far. The lull in Met coal prices since the acquisition, and the huge debt that the company undertook to finance the transaction, have been key factors for the deal not having worked out the way management hopped.

Another deal, however, the 2009 acquisition of the Jacobs Ranch mine, has been hugely positive for the company, and has been a major catalyst for increasing the company's footprint in low-cost production areas such as the Powder River Basin (PRB) region.

- Bottom Line Conclusion

In our opinion, based on our above valuation analysis, ACI ranks as a MODERATE BUY. However, investors should monitor market prices and demand for alternate fuel resources such as Natural Gas over the next quarter or two. Further declines in the prices of coal alternatives will have a bigger (negative) impact on coal demand than what we currently see.

—————-

Best of luck in your investing,

Don’t hesitate to email us if you have any questions, comments or feedback,

MarketConsensus Stock Analysis Desk

Stay in Touch:

Contact Us (Questions/Comments)

Facebook (Like MarketConsensus)

Google + (Connect with Us on Google+)

Twitter (Follow Us on Twitter)

————————————————————————————————-

[related2][/related2]

(By: Monty R. – MarketConsensus News Contributor)