How Much Do I Need To Retire – at any age, or at 55, 62 or 65?

Before you actually start building a retirement plan, it would behoove you to ask yourself: How much do I actually need to retire?

Planning your retirement, without first knowing how much it will take for you to retire comfortably, is like picking out the furniture for a home that you haven't yet built!

Fortunately, there is a perfectly logical way to answer the question “how much do I need to retire at any age, 55, 62 or 65?”

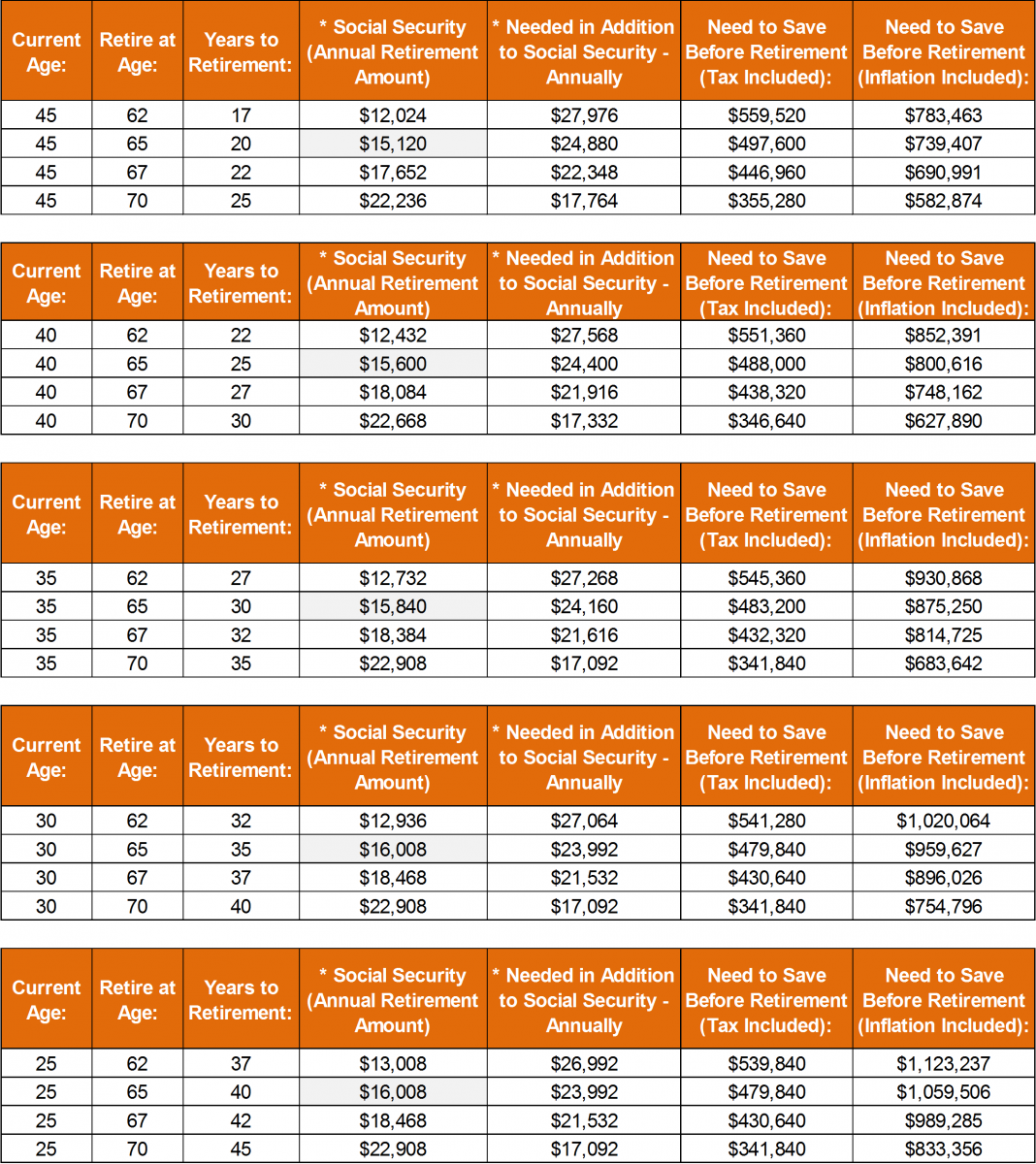

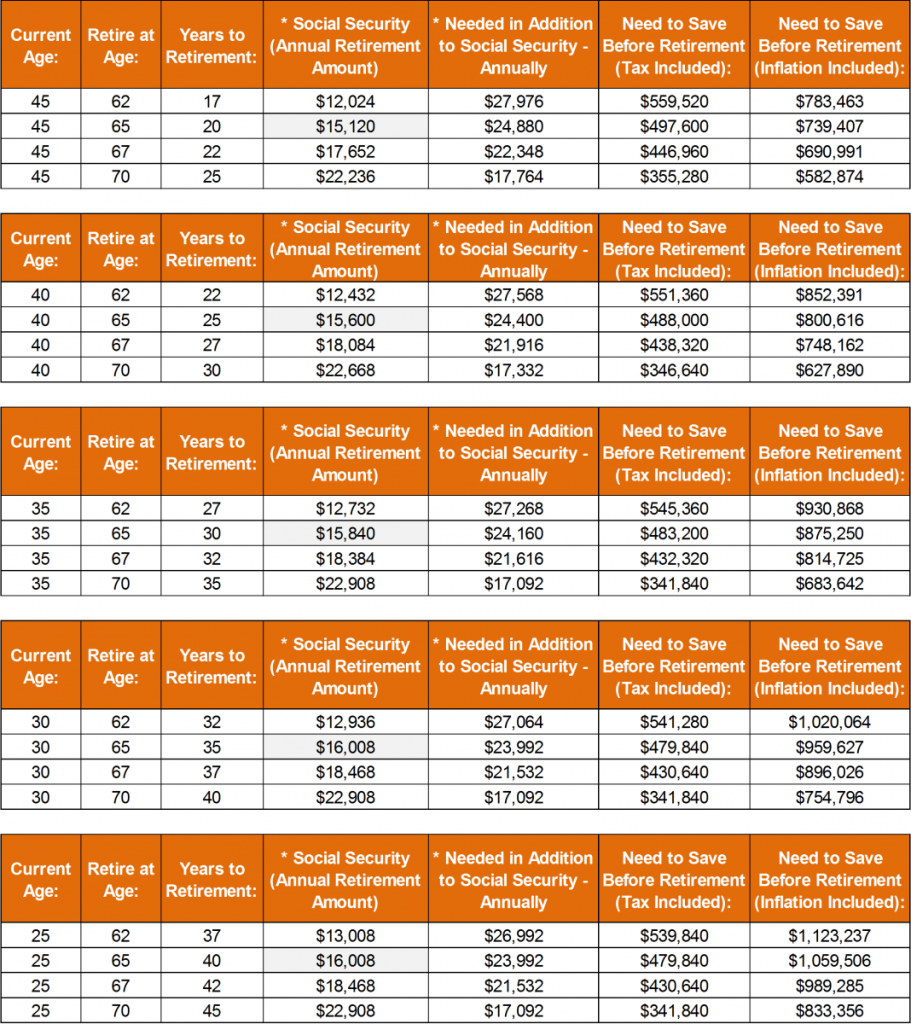

Before going into all the details, the below table provides an estimate of how much you’ll need to retire.

Need to Receive $40,000 Each Year After I Retire

Let's assume you want to receive $40,000 each year after you retire, you'll need to save the below by the time you retire:

* Social Security Income: Actual amount to be paid each year – per Social Security Administrator's Calculation (as of 2014) – today's dollars

* The differences in the Social Security Income are due to this factor: If you choose to delay the start of benefits to a higher age, you can then receive a larger monthly benefit for the rest of your life.

* The younger you are today, the more inflation reduces the value of your savings each year before retirement. However, because you have a long time before you need to retire, you do not have to save as much money each year, as someone that is relatively closer to retirement.

Figuring it all out – the details on how much you need to retire

As you set about answering the question “How much do I need to retire at any age, or at 55, 62 or 65?” you need to ask yourself a number of leading questions.

The answers to these questions will likely be relative, depending on how old you are today.

Let's assume for a moment that you are 40, in that case:

- At what age do I wish to retire? (Answer: 65 – i.e. 25 years from today)

- Approximately how much will my post-retirement expenses be? In other words, how much do I need to spend when I retire? (For most people, the answers is around $40,000 annually, or roughly $3,333 monthly)

- What rate of return do I expect on my investments? In other words, if I start investing today, how much investment growth do I need by the time I retire to earn my desired retirement income? (Let’s assume a 6% annual growth rate)

- What will my post-retirement tax rate be? (Let’s assume the average rate of 20%)

- What rate of inflation do I expect during retirement? (Average: 2%)

- What will my estimated Social Security benefits be each month when I retire? (Based on the Social Security Administration (SSA) website, you could expect $1,300 a month in benefits, starting 25 years from 2014).

Now, with a bit of some creative math, we are all set to figure out the question, how much do I need to retire at 65?

Doing the math on how much you need in order to retire

If you are to spend $3,333 each month when you retire at 65, and Social Security benefits will provide $1,300 of that amount, it means you would require an additional $2,033 per month ($3,333 minus $1,300) to retire at 65. Therefore, the question becomes “how much more do I need to receive when I retire?” The answer is $24,396 annually (i.e. $2,033 multiplied by 12).

Now we need to figure out how much of a nest egg you need in order to generate that $24,396 a year.

How Much Nest-egg do You Need to Save in Total to Retire at 65?

The answer is $406,000 (before taxes)

Since you are expecting your investments to grow at a 6% rate annually upon retirement, the answer to the question “how much of a nest egg do I need to retire” is $406,600 ($24,396 / 6%).

But, what about taxes? If we have to factor in a tax rate of around 20%, then how much do you need saved in order to retire?

Including Taxes

Including taxes, you’ll need $487,916

Taking an average tax rate of 20%, your annual taxes on the $24,396, will amount to $4,879 a year.

In addition to what you’ll get from Social Security, you’ll need to receive approximately $29,275 each year [$24,396 (yearly expenses) + $4,879 (annual tax amount)] in order to retire comfortably and spend $40,000 a year during retirement.

If that's the case, then how much of a nest egg do you need to retire? The answer is: $487,916 ($29,275 / 6%).

Meaning, each year after you enter retirement, your nest egg of $487,916 will generate 6%, which will allow you to receive $29,275 of income each year.

Breakdown

+ $29,274: Annual Income (6% APY on nest egg)

– $4,879: Taxes (Each year)

+ $15,600: Social Security Income ($1,300 month * 12 months)

= $40,000 Each Year on Net Income (Rounded up)

= $3,333 Each Month of Net Income (Rounded up)

So, now we’ve figured out that when you retire in 25 years (at age 65), you'll need $487,916 in order to produce enough money annually for you to live out the rest of my days.

But what about inflation – that silent beast that erodes the amount that you currently save each year?

Nest-egg Erosion – Inflation

Assuming an average inflation rate of 2%, how much of a nest egg do you need to retire? And, it's back to Math-101!

The answer is: $487,916 x (1 + 2%)25 or $487,916 x (1.02)25

- $487,916 (which represents 100% of your nest egg), multiplied by

- 1.02 (to represent 102% if I need to account for a 2% inflation erosion)

- raised to the power of 25 (which represents 25 years to retirement) or 1.0225

In other words, you multiply your pre-inflation retirement nest egg by 1.02, by the number of years to retirement (in your current case, that's 25).

The answer is: $800,616

How Much do I Need to Retire at 55?

If you needed to know how much do I need to retire at 55? You would do the multiplication 15 times (i.e. retirement age 55 minus the current age of 40).

How Much do I Need to Retire at 62?

You’ll need $852,391 to retire at 62, at a current age of 40. See the table at the top of this article.

Conclusion

The math to figuring out how much do I need to retire at 55, 62 or 65? is really simple, once you know how much you need to spend each year during retirement.

The key to figuring out that number is realizing that when you do retire at 55, 62 or 65 years, you will need a lot more money saved to account for taxes and inflation.