What is Venture Capital – Definition and Overview

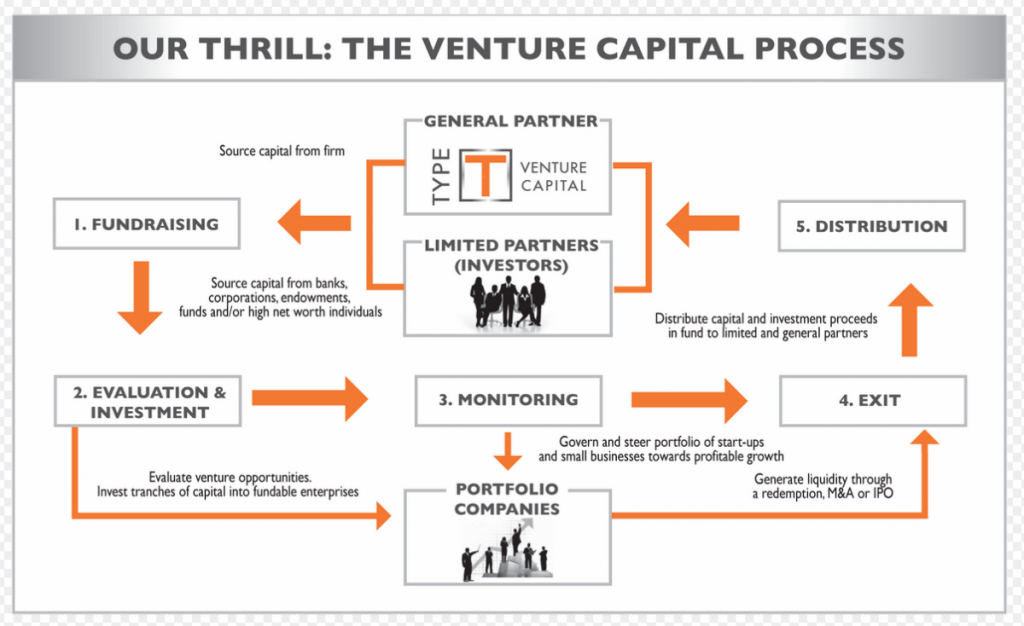

Venture Capital is funding provided directly to a startup or early-stage company. It can come from individual investors or venture capital firms, and is generally raised after the company has acquired seed funding and begun its initial operations.

Seeing a high potential for growth, venture capitalists will then inject capital into the company to expand and refine its business activities.

Venture capital is generally offered in exchange for equity or stake in the company, although licensing and royalty deals are sometimes substituted for direct ownership.

Additional Overview of Venture Capitalism

In addition to funding, many venture capitalists offer business connections and expertise to help the company grow. The idea is that a company, even though it surrenders equity upon the acceptance of venture capital, stands to become stronger and more profitable with backing from venture capitalists.

Since investors who provide venture capital will only earn profits if the business is successful, they have a direct interest in using their connections to increase the profitability of the business.

The goal of investors who provide venture capital is often to gain from the company's IPO or acquisition by another firm.