Do you know if you’re paying fees on your mutual funds? According to an AARP survey released March 2011, almost 71% of Americans did not realize they were paying mutual fund fees on the funds they had on their 401(k)s.

In a way this oblivion works to the mutual benefit of investors as well as mutual fund companies and financial advisors. Being unaware of such fees, investors worry less about the cost of their investments, while mutual fund companies and financial advisors can pass their overhead onto clients more easily.

However, if you really want to be ahead of the retirement planning game as an investor, understanding mutual fund fees and their impact on you is absolutely essential.

Other News: Will AAPL Stock Rise Again?

Investing in mutual funds can be a very good thing. The key to success, however, is in understanding what you are paying for and what you are getting in return. Make no mistake, sometimes you will lose big and other times you will gain significantly. But as you progress towards retirement you should expect an average steady gain. The challenge is deciphering whether you are actually making fewer gains than you should, because mutual fund companies don't really make it easy for you to know that.

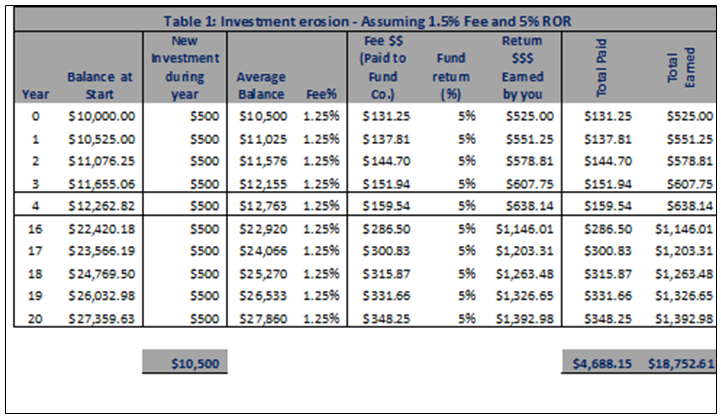

To help you understand the impact of mutual fund fees on your 401(k), let's consider a simple example. Assume that you started your 401(k) by investing $10,000 in a single mutual fund. Then you invest $500 additionally each year following your initial lump sum investment. Let’s also assume this particular fund has no transaction charges on mutual funds it manages. Many funds do charge an annual fee, however, so let’s estimate an annual fee of 1.25% for this fund.

For simplicity, we will assume that the fee remains the same over the 20-year life of our analysis, as does the fund's 5% annual return.

Consider what happens in 20 years when it's time to cash out. While mutual fund companies will proudly highlight the fact that they have helped you earn nearly 68.54% on your investment [$18,752 (Total Earned) divided by $27,359 (Total Invested)], you also need to consider some other stark statistics. Over the 20-year horizon of your investment, you have paid out $4,688 (25%) of your $18,752 earnings for mutual fund fees.

See also: iPhone versus Android – An Investing Perspective

Now let’s considered what might happen if the fund fee were slightly higher (say 1.35% instead of 1.25%) or if your returns were slightly lower (say 4% annually instead of 5%). Your "Total Earned" would drastically be reduced to roughly 60%, and this does not even factor in any transaction charges on mutual funds you may hold in your 401(k). Would you like to take a guess what impact those will have?

Not understanding mutual fund fees, and the corrosive impact they have on your retirement savings, prompts many a saver to live in blissful ignorance of the true significance that fees have on your investments. It's high time you took notice and acted now, to stem the flow from your precious nest egg.

[related2][/related2]