Best Mortgage Calculator 2014 | Top 3 Mortgage Payment Calculators with Taxes and Rate Amortization

Below is this year’s overview of the top three best mortgage calculators.

When finding a mortgage calculator to calculate loan amounts, rates and mortgage terms, consumers normally look for a calculator that takes taxes and interest rate amortization into consideration.

Online Mortgage Calculators

Online mortgage calculators are designed to help you determine how much you can afford to borrow on a home, property or commercial real estate.

See Also: What is P2P Lending? Should you Invest in Peer to Peer Lending or Stocks?

An all-inclusive mortgage loan calculator allows you to better generate an amortization schedule for your mortgage, shows you how much interest and taxes you'll pay, estimates your principal balances, and quickly shows you the effect of adding extra payments.

A True Sense of Your Total Monthly Payments

A top mortgage calculator will typically include monthly allocations and includes impact from property taxes and other forms of insurance.

A monthly payment mortgage calculator that includes taxes and insurance computation will estimate the monthly house payment based on the value of the home.

Don’t Miss: Selling a Home? 6 Reasons Why Homes Don't Sell, and What to Do About it

The calculator sets the default values for property taxes, mortgage insurance (PMI), hazard, and homeowners insurance.

These variables are provided to help you get a better sense of your overall total monthly payments (rather than just the principal and interest payments).

What Information Do you Need to Enter into the Calculator?

To use an online mortgage calculator, you need to enter some important information.

- Mortgage / loan amount (Subtract your mortgage down payment from the price of the house. If refinancing, then this number will be the outstanding mortgage balance).

- Mortgage / loan term (Duration of the mortgage – i.e., 15 or 30 years)

- Interest rate (enter your estimated interest rate or the rate that has been quoted to you)

- Mortgage / loan start date (expected or original closing date)

See Also: 6 Ways to Protect Your Wealth and Financial Assets

In some cases, you’ll need to also enter:

- Your credit profile (good, fair or poor credit)

- Purpose (loan refinance or new purchase)

- Property tax (To find this information, you can visit your county's assessor or recorder website or office. You'll need the complete property address. You can also use Zillow to find the tax for a particular property.)

[related2][/related2]

List of Best Mortgage Calculator

Here is the list of the top best mortgage calculators followed by a brief overview of each one.

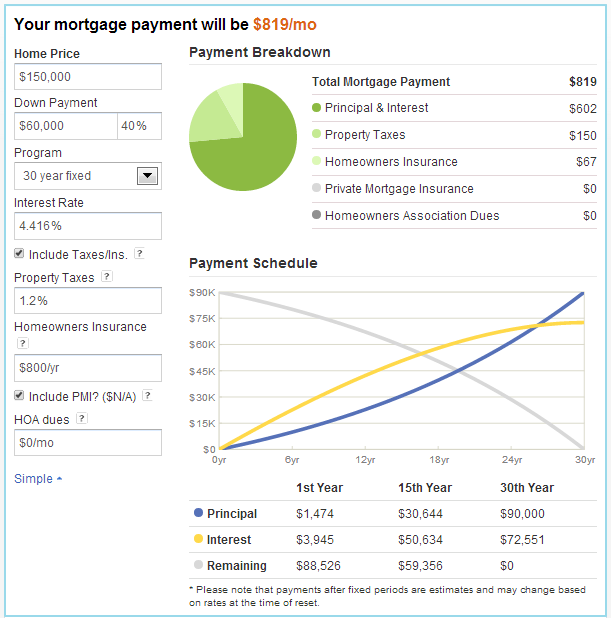

Zillow Mortgage Payment Calculator

Based on our research, we determined that Zillow has the best mortgage calculator. Compared to MortgageCalculator.org and Bankrate, Zillow’s calculator provides you with a more detailed level of property tax, homeowners insurance and HOA dues calculations.

Best of all, Zillow actually estimates these and other information for you, which saves you the time you would have spent gathering these extra information.

[related1][/related1]

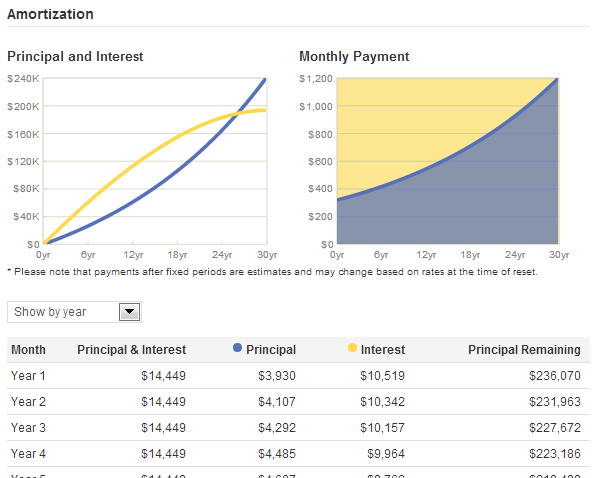

Zillow also includes a free comprehensive report that shows you the complete breakdown of all payments and costs, including your amortization schedule.

Zillow Mortgage Payment Calculator – mortgage calculator amortization

[related2][/related2]

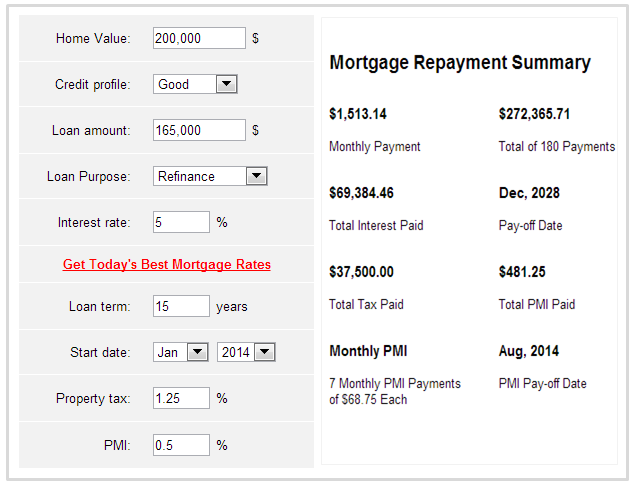

Mortgage Calculator

Mortgage Calculator is the second best mortgage repayment calculator available. It has a side-by-side input (enter information) and output (repayment summary) section. It also allows you to enter an estimated property tax and also input your PMI rate (mortgage insurance).

Don’t Miss: 8 Best Mutual Funds to Invest in 2014 (Ranking, Review and Comparisons)

PMI (Private mortgage insurance) allows loan borrowers to obtain a larger loan amount because the insurance protects the bank against default.

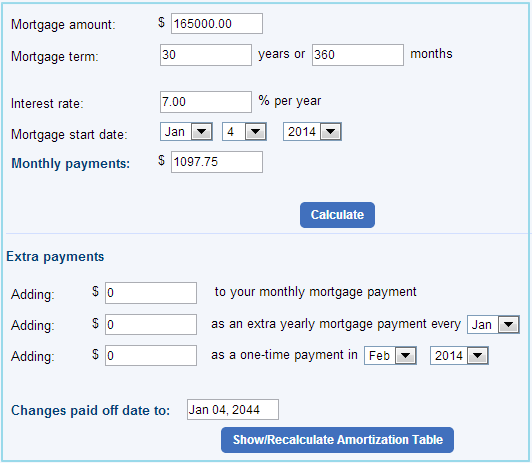

Bankrate Mortgage Calculator

Bankrate’s mortgage calculator is very basic. It provides you with a quick overview of how much your monthly payment will be and can also show the effect of adding extra payments.

[related2][/related2]