Alliant Credit Union Review – Pros, Cons, Complaints, Benefits, Rates

Alliant Credit Union is the sixth largest credit union in the United States based on asset size. The credit union services over 270,000 members across the country and is headquartered in Chicago, Illinois.

Completely owned and operated by its members, Alliant’s main mandate is to adequately service the financial needs of its members. The members are considered shareholders and are sourced from select business affiliates, associations, organizations and qualifying communities. Members and employees receive exclusive lifetime benefits.

Alliant Credit Union is chaired by Ed Rogowski who joined the credit union in 2009 and has held a number of positions in Finance throughout his career. Career banker Dave W. Mooney is President and Chief Executive Officer.

Alliant Credit Union Review

- Origin

- Credit Union Services and Products

- Rates and Fees

- Benefits/ Pros

- Issues/Cons

- Complaints

- Conclusion

Origin and Growth

Alliant Credit Union was founded in 1935 by a group of United Airlines employees under the name United Airlines Employees’ Credit Union. By the end of the first year of operation, there were 146 members and an asset base of $5,088.

Through product innovation and a strong focus on member benefits, Alliant has grown to over 270,000 members across America today. Alliant now has an asset base of over $8 billion and is considered the sixth largest credit union in the country. The Credit Union members are serviced by over 300 employees.

Members can access their Alliant account at over 80,000 surcharge-free ATMs across the country to process deposits, withdrawals and balance enquiries.

In 2014, Alliant Credit Union was added to the Honor Roll of Center for Companies That Care for the third consecutive year. Personal finance website NerdWallet also gave Alliant its stamp of approval for offering customer-friendly banking and an extensive suite of services to its members.

Alliant Credit Union Services and Products

Alliant Credit Union offers its many members a number of services and products to meet their financial needs.

The list includes:

- Savings accounts

- Checking accounts

- Health savings

- Certificates of deposit

- Education savings

- Individual Retirement Accounts (IRAs)

- Trust and custodial services

- Insurance

- Investment Services

- Credit cards (including reward cards and gift cards)

- Mortgages and home equity loans

- Motor vehicle loans

- Student loans

- Personal loans

Alliant Credit Union Rates and Fees

|

Product Type |

Rate |

|

Savings account dividend rate |

0.70% APY |

|

Basic checking account |

0.00% APY |

|

High rate checking |

0.65% APY |

|

Health savings |

0.65% APY |

|

Share certificate 12-17 months |

0.90% APY |

|

Share certificate 48-60 months |

2.10% APY |

|

Traditional/Roth/SEP IRAs 12-17 months |

0.90% APY |

|

Traditional/Roth/SEP IRAs 48-60 months |

2.10% APY |

|

Coverdell ESA 12-17 months |

0.90% APY |

|

Coverdell ESA 48-60 months |

2.10% APY |

|

Unsecured loans |

11.90% % APR |

|

Savings secured loans |

2.70 to 3.70% APR |

|

Student loans |

4.25 to 6.00% APR |

|

First mortgages |

3.155 to 4.470% APR |

|

Vacation home mortgages |

3.637 to 4.470% APR |

|

Home equity line of credit |

4.00% APR |

|

Home equity loans |

5.5 to 6.5% APR |

|

New vehicle loan |

1.74% APR |

|

Used vehicle loan |

1.99% APR |

|

Recreational vehicle loan |

2.99% APR |

|

Motorcycle, boat, aircraft loans |

6.25 to 7.25% APR |

|

Visa Platinum Credit Card |

9.24 to 21.24% APR |

|

Visa Platinum Rewards Credit Card |

11.24 to 23.24% APR |

|

Balance transfer rate |

0 to 5.99% APR |

|

Service Type |

Fee |

|

Initial deposit to open savings account |

$5 |

|

Federal insurance on savings accounts |

$250,000 |

|

ATM transactions |

FREE |

|

Electronic statements |

FREE |

|

Initial box of checks for checking account |

FREE |

|

Online banking transactions |

FREE |

|

Account closure within 90 days |

$10 |

|

Online check copies |

FREE |

|

Electronic transfer initiated by phone |

$10 |

|

Document request |

$5 |

|

Dormant account fee |

$10 |

|

Inactivity fee |

$10 |

|

Line of credit advance (per occurrence) |

$3 |

|

Insufficient funds (check or electronic item) |

$25 |

|

Overdraft transfer |

$3 |

|

Alliant Courtesy Pay |

$25 |

|

Paper account statement fee |

$1 |

|

Lost card replacement |

$10 |

|

Stop payment request (online) |

FREE |

|

Stop payment request (verbal or written) |

$25 |

|

Outgoing domestic wire |

$25 |

|

Outgoing foreign wire |

$50 |

|

Airplane loan fee |

$175 |

|

Copy of loan file |

$25 |

|

Copy of mortgage documents |

$5 |

|

Mortgage payment modification |

$250 |

|

Home equity loan rate modification |

$250 |

|

Payment history |

$5 |

|

Verification of mortgage |

$10 |

|

Credit card annual fee |

FREE |

Please see Alliant's website for the most updated rates and figures

Benefits of Using Alliant Credit Union

- No minimum balance requirement, monthly service fee or maximum balance limit on checking accounts

- No fees for point-of-sale transactions and writing checks

- Overdraft protection on checks, point-of-sale transactions and automatic payments

- Advances to cover overdraft through Alliant Courtesy Pay

- Custom Visa Debit Card design for Teen Checking accounts

- High rate option available for checking accounts

- Minimum balance of $5 to open regular savings account

- Dividends on savings paid monthly on daily balances of $100 or more

- Kidz Klub accounts for children under 12 years old

- Option to add parental and spending controls to Teen Checking accounts

- Online loan signing

- Alliant Platinum Rewards Visa credit card allows redemption of points to travel on major airlines, cruises and car rental upgrades with no blackout dates

- Rewards may also be used to purchase sports equipment, electronics and other services from participating merchants

- No annual fee on credit cards and no fee for balance transfers

- Multiple free credit card payment options, including from accounts held at other financial institutions

- 10,000 Alliant Rewards bonus points in the first 90 days of activation on purchases of $500 or more

Other Benefits

- Telephone banking using the 24/7 Alliant Self Service Telephone (SST) system

- Online banking

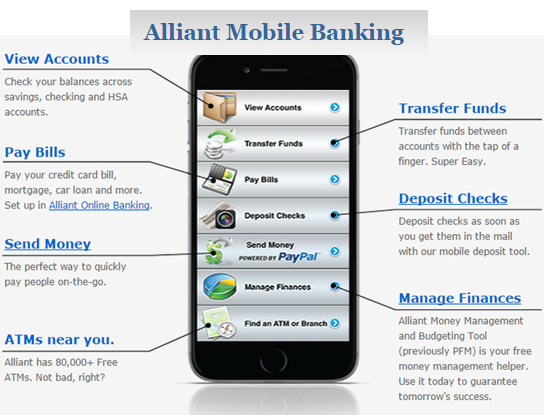

- Convenient mobile banking and check deposit using Android and Apple devices

- Personal customer service by phone

- Members Scholarship Program

- Free access to financial education webcasts

- Free financial wellness assessment

- Free financial counseling for members from GreenPath Debt Solutions

Issues/Cons

- Restrictive membership

- Extensive list of fees to transact business

- Branch locations in only a handful of states

Complaints

According to reviews on the popular job and career website Glassdoor.com, Alliant reportedly imposes high quotas and workload on employees, without adequate compensation.

There have also been complaints about the lack of investment in the Credit Union’s technological infrastructure and a shift from being member-focused to reportedly imitating the draconian practices of larger, public financial institutions.

Conclusion

Based on our research, Alliant Credit Union offers a wide range of products and services for members at various stages of life.

From youth accounts to investments and retirement accounts, Alliant offers competitive interest rates and monthly dividend payouts to qualifying members.

As the sixth largest credit union in America, Alliant provides convenient access through thousands of ATMs and multiple branch locations in the states in which it operates.