Lake Michigan Credit Union Reviews – High Yield Checking Account and CD Rates

These days, it has become very easy to switch between banks.

At the same time it has become very easy to feel overwhelmed based on the sheer multitude of available banking options.

During such times, it is important to remember that you aren’t simply looking for a place to move your checking or savings account.

Finding a bank that fits you financially and personally is a much larger task.

When you establish a new account, you’re beginning what could potentially become a lifelong relationship with a bank that, years later, could oversee and maintain your all of your financial accounts.

The following article presents the various pros and cons identified by our analysis of the Lake Michigan Credit Union.

Below, you’ll find the services it provides, the rates/fees it charges or offers, and a section devoted to consumer feedback and review.

Lake Michigan Credit Union Reviews – Origin and History

LMCU was originally founded as the Grand Rapids Teachers Credit Union in 1933 in response to a shortage of money during the great depression.

Soon enough, the firm outgrew its modest location in the founder’s home.

Over the years, the credit union would grow to more than 30,000 members and would manage over 40 million dollars.

In 2002, after decades of mergers and consolidations, the organization was re-branded as the Lake Michigan Credit Union.

As recently as 2010, LMCU has continued to merge with other local unions and now possesses over 3 billion dollars in assets.

Lake Michigan Credit Union Reviews – Rates and Services

12 Best Banks to Bank With | No Fees, High Yield Savings Accounts, Reviews

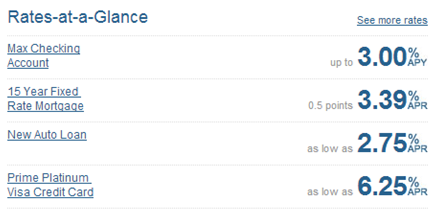

LMCU high yield CD APY rates:

- 5 Year CD Rate: 1.785

- 3 Year CD Rate: 1.094%

- 18 Month CD Rate: 2.50%

- 12 Month CD Rate: 1.50%

- 9 Month CD Rate: 0.50%

- 6 Month CD Rate: 0.50%

- 3 Month CD Rate: 0.50%

* Please check LMCU's website for the updated APYs and rates.

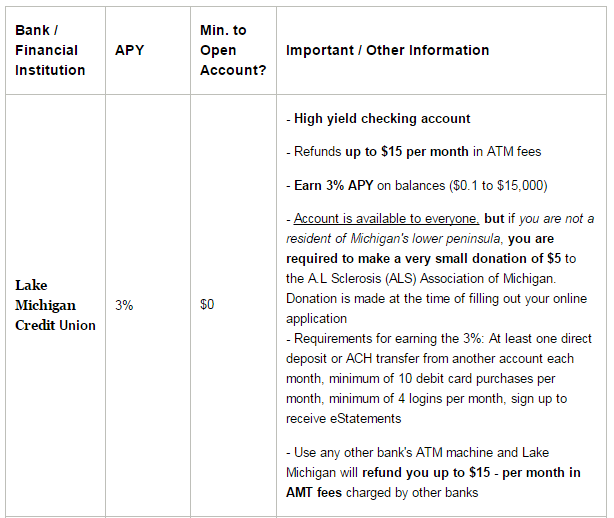

Benefits of LMCU’s Max Checking Online Banking Account

LMCU’s premier plan is named the Max Checking plan.

Max Checking offers the following rates and features so long as the following monthly conditions are met.

Features:

- 3.00% APY on balances of up to $15,000

- 0.00% APY on balances exceeding $15,000

- Refunds up to $15/month for ATM withdrawal fees from non-LMCU ATM’s

- LMCU has no monthly maintenance fees for its Max Checking accounts, but you must remember to login 4 times monthly – not necessarily a difficult task, but one that can be easy to forget for the busy out there.

- Creating and funding a new account is simple and painless.

- When you bank with LMCU, you have the flexibility of conducting your personal or business transactions via phone, chat, or using your computer.

Conditions:

To qualify for the 3% rate, you need to have the below:

- Direct deposit enabled

- 4 logins to the online home banking each month

- 10 debit card purchases during the month

- eStatements and eNotices enabled

Application Process

To apply online for the firm's Max Checking account, simply click “Sign up for Max” on the Max Checking page.

You will then be prompted to select how you qualify for LMCU membership.

To qualify, you must reside, work, attend school, or worship in the State of Michigan’s lower peninsula or donate to the Amyotrophic Lateral Sclerosis (ALS) Association, West Michigan Chapter.

The application form will provide a link to the ALS donation portal. The minimum donation is $5.

Some Complaints:

- Prone to paperwork mistakes

- Sometimes internally disorganized

Conclusion

LMCU has come an extremely long way since its inception as a credit-provider during the Great Depression.

In the last year alone, LMCU gained over 32,000 new customers, making them the 2nd largest Michigan-based credit union and the 47th largest credit union nationally.

Some highlights from their recent Annual Report include becoming the top mortgage loan originating credit union in Michigan, growing deposits by 12% to 2.45 billion, and showing loan growth of 20% in commercial banking.