Ford Motor (Stock: F) Valuation Analysis:

From a valuation perspective, one figure that jumps out at you is Ford's ROAE (return on average equity) of 281.62%. Such a high level of return shows management’s efficiency in generating return for the firm’s shareholders. Specifically, Ford has the highest ROAE in the industry.

Ford Motors’ EPS of 4.42 makes it an attractive stock from a fundamental perspective. Another attractive factor for investors is the firm’s doubling of its dividend. Ford raised its dividend from 5 cents to 10 cents a share.

Emerging Markets – The Opportunity:

North America makes up less than a quarter of the firm’s worldwide auto sales. There is significant opportunity abroad and in densely populated countries such as China, India and Indonesia. The introduction of the EcoSport SUV signifies Ford's desire for global appeal and to really compete with the likes of Toyota (TM).

This isn't going to be easy given Toyota's impressive valuation metrics, but one thing is for sure: Toyota does not come close to Ford's potential upside of 50% and that's really what a lot of investors care about.

Stock Analysts Recommendations

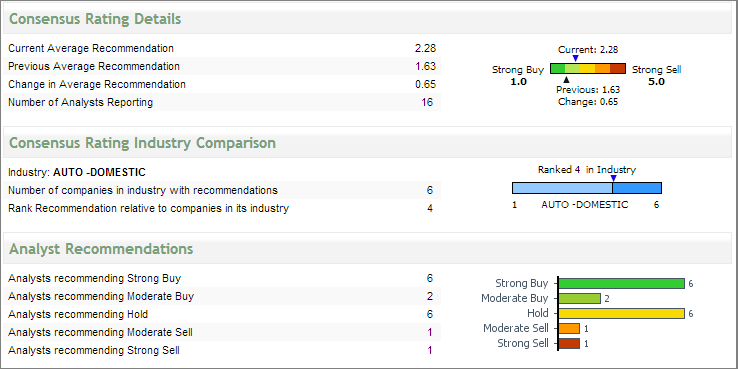

Stock analysts have given Ford stock a consensus rating of "Moderate Buy". From a scale of 1 (Strong Buy) to 5 (Strong Sell), they have rated the stock a 2.28

Source: QuoteMedia

How to Trade Ford:

For the last couple of weeks, the company’s stock price has been under pressure. However, long-term investors will find the stock attractive based on solid valuations and economic tailwinds.

Technically Speaking:

The 100-day MA (moving average) for the stock shows that Ford stock is technically healthy as it is above the 100-day MA. This seems to be a profitably entry point for Ford bulls until we gather more technical information.

The MACD is something MarketConsensus News has used from time to time and it shows a bearish crossover indicating that it is time to sell. But value investors will note that the MACD is more for short-term and intra-day traders. But, since we are factoring it into our analysis, MarketConsensus News wants to point out that the stock's MACD is getting dangerously close to zero. This is good for Ford bears since it signals that the short-term average is below the long-term average, indicating downward momentum.

(By: Vinayak M. – MarketConsensus News Contributor)

[related2][/related2]