Wells Fargo (Stock: WFC) started 2013 with a bang on a stellar Q4 2012 earnings report. The stock has been rising since November of 2012 as investors snapped up shares in anticipation of a better than expected revenue numbers. A lot of investors are now asking whether WFC stock is a good buy, sell or hold in 2013.

Wall Street Outlook

Wells Fargo’s business is cyclical in nature. It does well in times of economic expansion and contracts in times of economic stress. As long as the U.S. and global economies continue to grow, investors should see the stock appreciate in the long term. Wells Fargo has been great at managing cost and driving growth in its core businesses. This has analysts bullish on the stock with overall analysts market consensus estimating the stock price to reach $70 in the next five years.

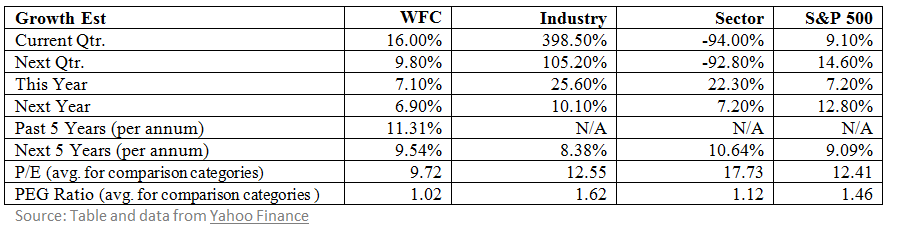

The healthy P/E ratio of 10.30 and the EPS of 3.36 are indicative of the growth prospects, and WFC should easily outperform the S&P 500 this year. Investors with some amount of risk appetite should seize this investment opportunity.

Other News: Top Ten Banking Stocks for Individual Investors

The Technical Picture

Although Wells Fargo stock, WFC, has been on a continuous uptrend for the past four years, the stock has been trading in a very tight range. Technical analysts will be pleased with the below stock chart, given that Wells Fargo is trading above the 20-Day Moving Average (DMA) and the 50 DMA and 200 DMA. The MAs along with the higher highs and higher lows seen in the candlesticks signify a great buying opportunity.

The stock’s support level is $31.50 a share and the resistance level is at $44.60 a share.

Investment Idea

At around $35 a share, WFC is currently trading at a discount. Stock analysts forecast that the stock will jump to around $50 per share in two years’ time. Buying at a target price of $35 a share and selling when the stock hits $50 will return a 42.8 percent rate of return.

Wells Fargo has a market cap of $184.48B and is well capitalized to meet its capital requirements by over 300 basis points. It's no wonder the stock has received "overweight" ratings.

[related1][/related1]