- Technical Perspective (Will ZNGA Stock Rise Again?)

(Continuing from "Is Zynga Still King or is the Zing Gone? Is ZNGA Stock a Buy or Sell?").

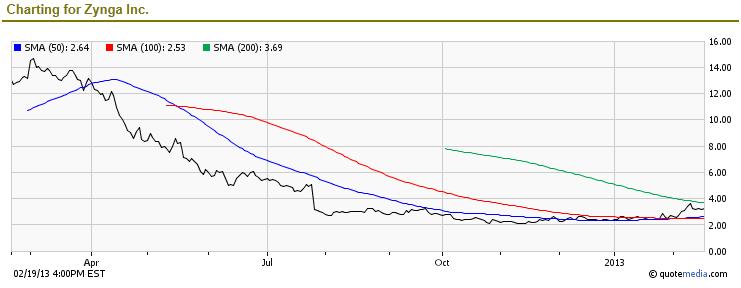

In the past 52 weeks, ZNGA's stock has been trading between a range of $2.09 and $15.91, which represents a fairly wide trading range.

At the time of this analysis, the stock is trading at $3.25, which is only $1.16 higher than its low 52-week trading range value and significantly lower (by $12.66) from its 52 weeks high. A lot of stock investors are now wondering if Zynga Stock (ZNGA) will ever rise again.

- Favorable Catalysts

Zynga has no doubt dominated the Facebook gaming scene, and has been able to exploit cross-selling opportunities on the Facebook platform. While the company has reported consecutive quarterly declines in Daily Active Users (DAUs) and Monthly Active Users (MAUs), it has also showed that it can turn those numbers around quickly. Two instances in point are the extreme DAU increase of an acquired game, "Words with Friends" that Zynga was able to deliver within a record 120 days of acquiring the game, and "CityVille" which made the top-5 list within 2 months of launching.

However, the competition is heating up quickly, as shown by the huge popularity of "Angry Birds" (produced by competitor Rovio). Development of games has become fairly cheap, with new development companies willing to work on razor thin margins. Since development is no longer a high barrier to entry, Zynga will need to look at other catalysts that can deliver profitability and margin growth.

One avenue to do both would have been to ride on Facebook's success, since 95% of Zynga's revenues are generated from within that particular ecosystem. However, since mid 2010 Facebook has been taking 30% of Zynga's "virtual goods" sales, which put a significant dent in the game-makers revenues. Then, in late 2012, the two partners further loosened their so far hugely successful partnership, putting the two into possible competition with each other. Zynga can no longer look for preferential treatment from the social networking giant. Diversification into non-Facebook environments seems to be the only option left. And moves such as the partnership with toy maker Hasbro might be a favorable catalyst for future earnings.

The other catalyst for growth could be a "growth through acquisition" strategy. Unfortunately, the company's $210M acquisition of OMGPOP was largely a failure, resulting in an almost $85M Q3-2012 write off. A proposal to acquire "Angry Birds" creator Rovio for $2.25B was spurned by Rovio management, and a 2011 one billion dollar attempt to acquire PopCap Games didn't end too well either, with rival EA winning the day.

Unless Zynga is able to identify suitable targets quickly, and pay a reasonable price for their assets, "growth through acquisition" may cease to become one of the potential catalysts for its success.

- Bottom Line Conclusion

Competition in the Social Gaming environment is heating up, especially as more and more entrants into the field are focusing on monetizing mobile gaming to push up their DAUs and MAUs. Based on the analysis provided above, it would seem as though ZNGA has yet to prove whether it can survive and thrive in the mobile market, especially as a force independent of Facebook.

For those reasons, we would classify ZNGA as a HOLD, with a recommendation to SELL if the company reports another few quarters of declining DAUs and MAUs.

(By: Monty R. – MarketConsensus News Contributor)

[related2][/related2]