While we acknowledged the risks facing Bank of America's upward momentum, MarketConsensus still rates BAC shares as a buy and technically speaking the stock is on an upswing that would see it surpass analysts' price targets.

See Updated Article: Is BAC Stock a Buy? Bank of America Stock Surges by 78% – Buy Sell Analysis

Source: freestockcharts.com

We wanted to point out that the stock is trading above the 20-, 50-, and 200- Day Moving Average. The higher highs and higher lows confirm the uptrend here. The above symmetrical triangle formation has been put in there to assist investors in identifying the point where the stock will break on its bullish upswing; it will be just over the triangle formation according to our chartists here at MarketConsensus News.

Source: Daily Finance

As can be seen from the chart above, BAC stock price has risen 58.23% over the last year making it the best performing bank stock in the Dow despite all the negative press. There is no denying that BAC has fallen off from its prime time years during the 80s and 90s and also for a brief period in the middle of the last decade. Nonetheless, the question on investors' minds is whether the Big Four bank will have a turnaround in 2013.

BAC focusing more on profits

The nation's second largest bank has realized that less is more. Unlike Amazon.com Inc. (AMZN), BAC is now a highly profitable franchise that has made less deals than in previous decades. Top management has realized that focus is better than deal blitzes and M&A sprees. This is how BAC has managed to boost its market cap to $124.81B after the losses it suffered during the wheeling and dealing days of former CEO Ken Lewis. The 46.51 P/E value speaks to this expectation of high growth through increased focus.

The downsizing at BofA will be appealing for dividend investors. Even though the stock has a low 0.34% dividend yield right now, there is reason to be optimistic given that it has a 5-Year average dividend yield of 3.77%. Moreover, investors might be optimistic that BAC will return more to its shareholders, as it has done in the past like when it had a dividend yield of 23.61% in the quarter ended March 2009.

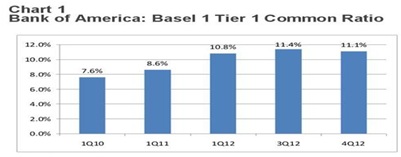

Furthermore, the capital raises is good news for BofA investors, as the bank now has a Tier 1 common ratio around 9.25% which is well over the minimum of 8.5% that the firm has to maintain.

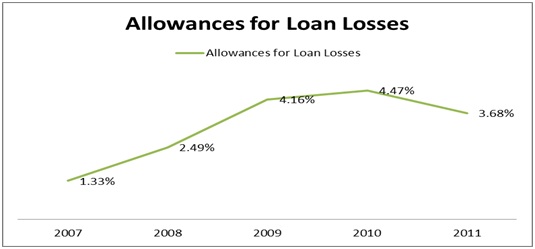

A Decline in the Allowances for Loan Losses

Increased earnings growth and higher profit margins is what BofA anticipates since the bank has reduced its allowances for loan losses going forward.

Bottom Line: Investors stand to profit from BAC in 2013 and beyond

The economic recovery and rising demand for mortgages make a good case for investors to hold BofA stock as we have previously recommended. Moreover, the bank has committed itself to cost cutting measures that will boost its net income.

(By: Vinayak Maheswaran – MarketConsensus News Contributor)

Good luck in your investing,

MarketConsensus Stock Analysis Team

Stay In Touch:

Facebook (Like Us on Facebook)

Twitter (Follow Us on Twitter)

Google + (Connect with Us on Google+)

Contact Us (Questions/Comments)

Enter your e-mail address on the “Never miss a post!” section on the top right of this page and receive articles as soon as they are posted.

————————————————————————————————-

[related2][/related2]