Forward Looking on Netflix Stock (NFLX)

(Continuing from "Is Netflix Stock (NFLX) a Buy, Sell or Hold?")

On January 23, 2013, Netflix reported that it had added 2 million new members in the last quarter of 2012, "a very healthy number compared to the 1.2 million added in the previous quarter, and the less than 250,000 added in the final quarter of 2013". Looking forward, Netflix (NFLX) projects the addition of yet another 1.7 million new subscribers in the first quarter of 2013.

Despite the increase in new members, Netflix management is already tempering investor expectations by stating earnings for 2013 were likely to "remain flat". Also of some significance is the fact that the NFLX's DVD-by-Mail service in the U.S. declined to 8.2 million customers in Q4 – a reduction of nearly 380,000 customers. In fairness though, Netflix has signaled its desire to move away from the DVD business.

Some analysts continue to question the company's ability to pay top dollar for Hollywood movie and TV content. The key in the coming years therefore will be the ability to deliver exclusive original content to its subscribers in the face of renewed competition, not only from Hulu and Amazon, but also from Verizon's Redbox Instant service, and Video-On-Demand offerings by many cable TV operators in the US and globally.

In order to meet the competition head on, investors will be looking for more bold moves similar to the company's exclusive deal with Walt Disney late last year, which should start delivering exclusive content to Netflix subscribers beginning in 2016. One positive sign is the talk that Netflix is considering similar exclusive content deals with Sony Corporation's movie studio.

Technical Analysis

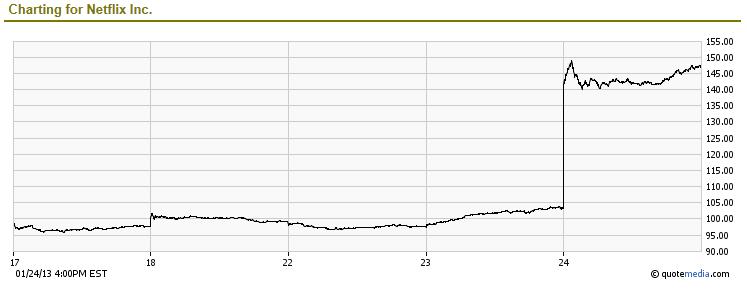

The stock rallied sharply following the earnings report. Pre-announcement, on Jan 22, the stock closed at $97.81.

However, following the Jan 23 announcement, the stock closed $103.26, and one day after, Jan 24, the stock has added nearly 50% more to its pre-announcement value to close at $144.86. Some of this volatility could also be attributed to short covering, which in turn is spiking up the price of the stock. Given this huge spread in stock price, it may not be meaningful to evaluate NFLX using traditional 30-day, 50-day or 200-day moving averages. Investors will however do well to closely watch where the stock goes from here over the next several days to see where it finally finds support. Astute investors who have a significant position in NFLX would also do well to trim some of their holdings to lock in profits at this point.

However, following the Jan 23 announcement, the stock closed $103.26, and one day after, Jan 24, the stock has added nearly 50% more to its pre-announcement value to close at $144.86. Some of this volatility could also be attributed to short covering, which in turn is spiking up the price of the stock. Given this huge spread in stock price, it may not be meaningful to evaluate NFLX using traditional 30-day, 50-day or 200-day moving averages. Investors will however do well to closely watch where the stock goes from here over the next several days to see where it finally finds support. Astute investors who have a significant position in NFLX would also do well to trim some of their holdings to lock in profits at this point.

The Bottom Line

For now, shareholders can rest comfortably that NFLX will likely be a good investment, at least for the short term. It remains to be seen however how much pressure the push to gain access to exclusive content (like Disney and Sony) will place on the company's finances. Also, investors will do well to watch for similar moves by NFLX's competitors, which could definitely squeeze margins for the company.

Based on this assessment, NFLX would be rated as a "Strong Hold".

(By Monty R. – MarketConsensus News Contributor)

[related2][/related2]