EverBank Reviews | Pros and Cons of Using EverBank (High Yield Checking, CDs, Rates)

This review of EverBank is a follow up to our annual list of “the Top Banks with High Yield Savings and Checking Accounts.”

EverBank was one of the banks included on our list of best online banks, and the below review analysis presents a more detailed overview of the pros and cons of using EverBank.

Based on our research, the below article aims to present an objective review of EverBank services, rates, benefits, high yield checking account, and customer complaints.

EverBank History and Growth

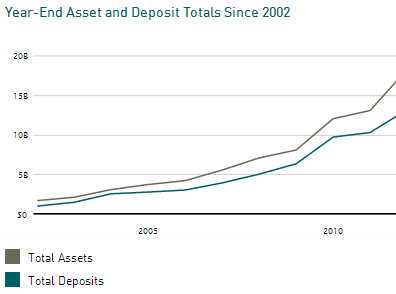

EverBank was founded in 1994 in Jacksonville, Florida. Being a relatively new bank, it's quite impressive when you take a look at their more than 19 billion dollars in total assets.

What's more impressive is that they've been able to achieve this growth strictly as an online bank without any physical branches.

[related1][/related1]

EverBank Products and Services

- EverBank High Yield Checking

- Money Market Savings

- High Yield CDs

- Mortgages and Other Loans

- Credit Cards

- Investing Services

- Business Accounts

Pros – EverBank Review

How can EverBank afford to provide such high yield rates and still remain competitive? The key lies in their distinctive online banking process and business model.

Because most of their business is done online, they don’t have to pay the same level of overhead cost and other branch staff expenses as other banks with physical branches.

Similar to other online banks like Ally Bank, Capital One 360 and GE Capital Retail Bank, EverBank provides high yield savings and online checking account rates, but most especially for new customers.

[related2][/related2]

Savings & Checking Account Rates

EverBank currently offers a first year APY (Annual Percentage Yield) of 0.86% for its money market savings accounts. In addition to this, it pays a 1.10% APY bonus on balances up to $50K for the first 6 months.

- EverBank: 0.86% + 1.10% Bonus

- AMEX Bank: 0.85%

- Sallie Mae Bank: 0.85%

- Ally Bank: 0.84%

* Bonus is only paid for the first 6 months * Rates and APYs are accurate as of 10/4/2013

For its high yield checking account, EverBank offers the below rates for new customers.

1st Yr APY – Checking (EverBank vs. Ally)

- EverBank: 0.76% + 1.10% Bonus

- Ally: 0.40%

- * Above rates are provided for balances: $0.01 – $9,999 * Rates and APYs are accurate as of 10/4/2013

[related1][/related1]

Cons

As noted above, EverBank offers really great rates to new customers.

In year 2, when you are no longer considered a “new customer”, the ongoing rates offered by EverBank drops drastically. Starting the 2nd year, EverBank pays you a savings rate of 0.61%.

This is a 69% drop from the combined (0.86% + 1.10%) rate that was offered to you during the first 6 months of opening your account.

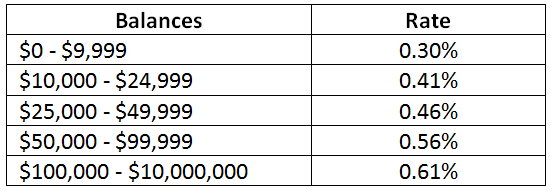

As for the checking account yields provided to regular customers (starting in year 2), the rate drops to what is presented in the below table:

*Above rates are accurate as of 10/4/2013. Rates could change without notice

Unlike other top online banking firms that do not require a minimum balance to open a new account, EverBank requires a $1,500 initial deposit. As such, it might not be a viable new account option if you do not have the required initial deposit.

Over time, a lot of the high yield providing banks will reduce their promised yields. However, most of them do not reduce their offered yields as drastically as is being done by EverBank. These banks normally reduce such yields slowly over time and they normally do these based on market conditions.

[related1][/related1]

Everbank Consumer Complaints

Just about any large company is going to have its share of consumer complaints, that's just something that comes along with doing business on a large scale.

EverBank does have its share of customer complaints, but also has good reviews. As a matter of fact, they have one of the highest good to bad review ratios of any bank, online or off.

However, you should know that the most common complaints revolve around the following topics.

- Customer service issues

- High initial deposit

- No auto loans

- No personal loans

- Some instances of processing delays

________________________________________________________

[related2][/related2]