PNC Bank Reviews 2014 | Overview of PNC Rates, Fees, Complaints, Online Banking

When thinking about changing banks or getting a new account, there are multiple factors that most people consider. These include fees, types of services, ease of use and customer service provided.

As a follow up to other reviews that we’ve published on banks like Ally Bank, US Bank, GE Capital and many more, we are releasing this 2014 report based on our analysis and review of PNC Bank.

This includes a detailed overview of PNC Bank services, customer reviews, rates, fees, pros, cons and PNC Bank customer complaints.

PNC Bank Reviews 2014 and Analysis

- Origin & Growth

- Services Offered

- Rates & Fees

- What’s So Special About PNC Bank?

- PNC Bank Core Values

- Consumer Complaints

- Conclusion

Origin & Growth

PNC bank traces its heritage all the way back to 1852, under the name of Pittsburgh Trust and Savings Company.

In 1853, the bank had its first name change (to the Pittsburgh Trust Company), which would be the first of many name changes in PNC history.

From 1853 to 1959, PNC experienced a series of mergers and other changes. Starting in 1959, the bank became known as Pittsburgh National Bank. In 1982, Pittsburgh National Corporation would merge with Provident National Corporation to form a new entity by the name of PNC Financial Corporation.

Wells Fargo Review – How does Wells Fargo Rank When Compared to Other Banks

At the time, this merger became the largest bank merger in American History

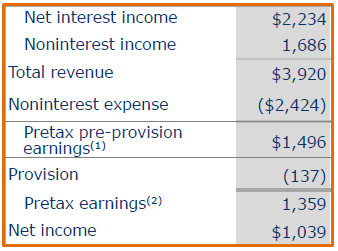

From its beginning, PNC has grown rapidly. Today, it controls more than $270 billion in assets while maintaining equity of more than $37 billion. PNC employs more than 51,000 employees and reported $1.039 billion in Q3 net income.

Ally Bank – Top Online Banking Firm

Services Offered

PNC Bank provides a wide range of banking services designed for consumers, small businesses, and major corporations and institutions.

Here is a list of their services broken down by category.

For Personal Banking Customers – Checking, online & mobile banking, savings, mortgages, personal loans, lines of credit, credit cards, retirement planning, investment services, and wealth management services.

For Small Business Banking Customers – Online business services, checking, savings and liquidity, business loans, credit services, making and collecting payments, merchant services, account services, credit cards, debit cards, employee benefits.

Chase Bank Reviews 2014 | Before You Open a Checking, Savings, CD Account

For Corporation/Institution Banking Customers – Financing options, treasury management, capital markets, international services, financial institution services, institutional investment management, corporate & institutional resources.

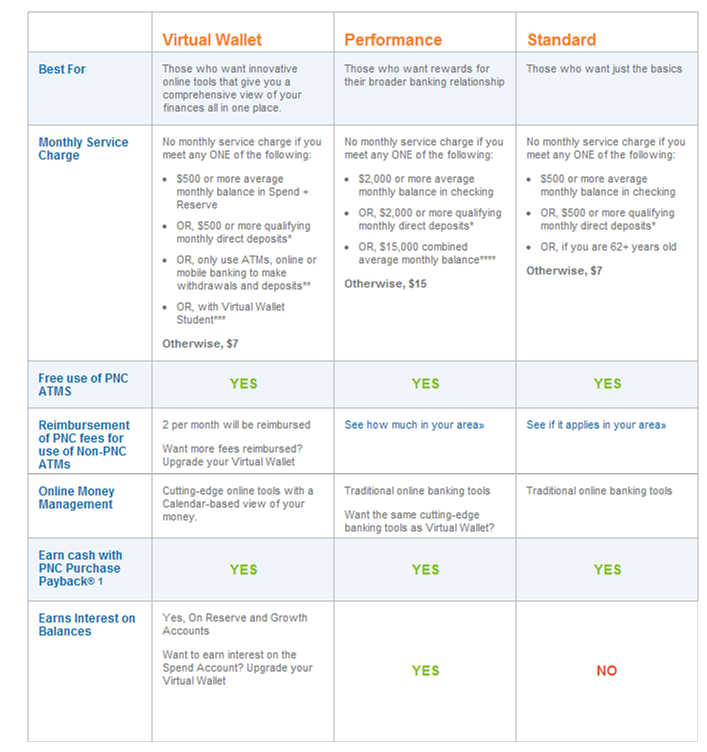

PNC Checking Accounts – Comparison

PNC Rates & Fees

Unless you get a promotional offer, all of PNC’s checking accounts offer a .01% APY. When it comes to savings, depending on the account you choose and the size of balance you maintain within the account, you will earn anywhere from .01% APY to .14%.

Bank of Internet USA Review and 2014 Analysis

With money market accounts, you can earn from .05% to 1.4% APY.

PNC CD rates range from .04% to 1.5% APY depending on the length of the CD term as well as choice of CD and balance carried.

Consumers who chose to save with PNC tend to rave about what they believe to be incredibly competitive return rates.

PNC Bank offers checking accounts with monthly maintenance fees starting at $7.

Their savings account monthly fee is even lower, weighing in at $4.

American Express Savings | What You Should Know Before Opening an Account

What’s Special About PNC Bank?

First off, customers seem to love how many branches are available.

However, aside from just having many branches available, consumers rave about the in-branch customer service that they receive.

Another thing PNC customers seem to really enjoy is the promotional offers. For instance PNC was offering $150 free for opening an award winning virtual wallet checking account (that offer has now expired).

Finally, consumers like PNC because of the wide range of services that they offer. The truth is that, few people like banking, and even fewer like having to dig through multiple accounts to manage their money.

Because PNC offers so many different banking services, it’s possible to keep all of your accounts with this one bank. This makes managing your money a much less stressful process.

TD Bank Review, Detailed Analysis and Ranking of TD Bank

Consumer Complaints

As with any large corporation, PNC is no stranger to consumer complaints. Here are the most common reasons that customers of PNC Bank complain.

- Monthly statements not being sent on business accounts.

- Poor collections practices.

- Online platform issues.

SunTrust Bank Reviews | Top 3 Pros, Cons You Should Know About Suntrust

Conclusion

Overall, PNC Bank is revered to be a great financial institution by its users. Some of the things that consumers enjoy most about PNC Bank are their strong core values, uncontested customer service, and major promotions offered.

Although PNC Bank does have its share of negative reviews, a quick search also shows tons of positive reviews to counteract the negative. PNC offers standard rates for the industry and competitive fees.

Overall, they seem to be a great choice for consumers, businesses, corporations and institutions.